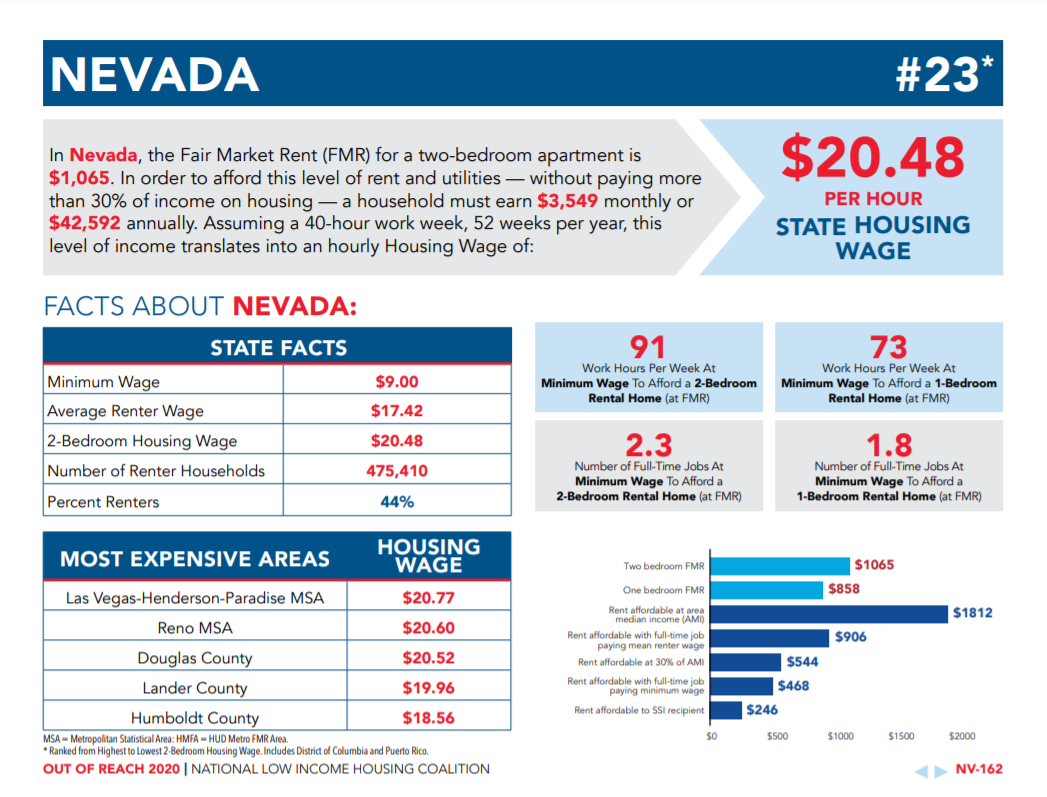

The National Low Income Housing Coalition (NLIHC) recently published its 2020 Out of Reach: the High Cost of Housing report, which found that Nevadans must earn $20.48 per hour to afford a two-bedroom unit at Fair Market Rent (FMR). Given that Nevada’s minimum wage is just $9.00, most renters are working multiple jobs, well over 40 hours per week, to afford a home.

Housing is considered affordable when a household spends no more than 30% of income on rent. Due to a shortage of housing across the nation, especially in Nevada, renters are finding it more difficult to locate and pay for housing that is stable, reliable, and located in opportune areas. In fact, the NLIHC reported that Nevada ranked last for the number of affordable homes for severely low-income renters – there are just 18 affordable and available homes for every 100 renters in Nevada, which is due in part to the rising costs of development and little financial mobility.

The NLIHC Out of Reach report assesses housing costs between states to measure the disparities in housing costs and household incomes. Nevada is ranked 23rd for highest housing wage in the U.S., and it is estimated that residents would need to work an average of 91 hours per week at minimum wage to afford a two-bedroom home, or 73 hours per week at minimum wage, to afford a one-bedroom home at FMR. This report also found that average renters in Nevada only earn about $17.42 per hour, which places them below the required housing income for a two-bedroom unit at FMR.

The Las Vegas-Henderson-Paradise MSA is reported as the most expensive area of Nevada to live in, which hits home for our organization. Nevada HAND’s 35 communities are spread out in various areas of Southern Nevada, including Las Vegas, Henderson, and North Las Vegas, so the critical shortfall of affordable homes in our region further supports the need we address. Seniors, adults, and children deserve communities that are affordable, stable, and more than a home, but increasing costs often forces renters to often choose between housing and other necessities, especially now, in a time of uncertainty and global economic hardships.

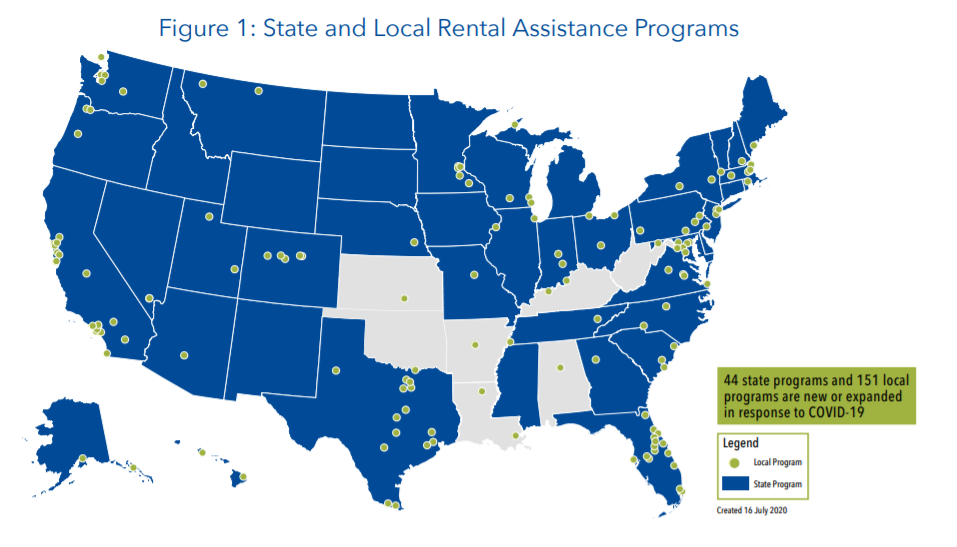

In addition to the Out of Reach report, the NLIHC responded to the rising concerns around rental assistance during the COVID-19 pandemic. According the Out of Reach report, 44% of households in Nevada are renters. The NLIHC published a research note addressing local and state funded rental assistance programs and how they have made an impact on renter households; “as of mid-July, NLIHC had identified 44 state programs and 151 local programs that have been created or expanded in response to COVID-19 and its economic fallout.” To meet the urgency for rental assistance and other financial programs, local and state nonprofits and other organizations have been working to create and maintain fair programs for renters in need, but many rental assistance funds are short-term, placing renters at risk of accumulated costs and potential eviction pending moratorium lifts.

Affordable housing opportunities and rental assistance are crucial to the sustainability of our communities and our economy, especially in Nevada. To learn more about the cost of housing in Nevada, review the NLIHC’s Out of Reach: the High Cost of Housing report. For more information on local and state rental assistance programs and the proposed plans for protecting our nation’s renters, review the NLIHC’s Research Note.